Income Tax Forms

What is Income Tax Form?

The Income tax Act prescribes various procedures like filing of income tax returns, filing of TDS returns, payment of tax, issue of notices and recording response to such notices and passing of such orders and many more. All these procedures either seek information from you, show the information about you or pass orders after processing the information. These procedures are done in a specific manner laid down in the Income tax Act and relevant rules. These procedures also prescribe specific forms for gathering or processing of such information. The major income tax forms which are relevant for large number of taxpayers are as below:

Serial number | Form No. | Description |

|---|---|---|

1 | 16 | Certificate issued by the employer in respect of tax deducted at source (TDS) from income chargeable under the head “Salaries” |

2 | 16A | Certificate issued by deductor for tax deducted at source in respect of income other than “Salaries” |

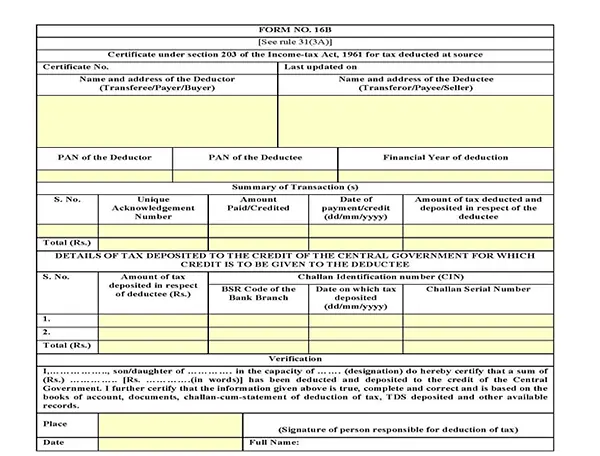

3 | 16B | Certificate issued by purchaser of immovable property for tax deducted at source in respect of purchase of immovable property |

4 | 16C | Certificate issued by lessee for tax deducted at source in respect of payments of rent to the lessor |

5 | 26AS | Annual Tax Statement of the person prepared by Income tax Department wherein credit of all the taxes paid by the person can be seen |

6 | 15G and H | Declaration under sub-sections to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax. |

7 | 49A |

Application for Allotment of Permanent Account Number (PAN) [In the case of Indian Citizens/Indian Companies/Entities incorporated in India/Unincorporated entities formed in India] |

Form No. 16: Certificate of TDS for salaried individual taxpayers

What is Form No. 16?

-

The employer deducts tax on the income from salary paid to an employee. The employer is required to deposit such TDS into a Government Account and furnish a statement of TDS to the Government.

-

The employer is also required to furnish the details of such income and TDS deducted to an employee in a prescribed manner. Such a manner is prescribed as Form No. 16.

-

The employer is required to furnish details of TDS to an employee in Form No. 16 before 31st May of the F Y immediately next Financial Year.

-

This statement in Form No. 16 is very important for an employee to furnish his Income tax returns and he must examine each column and the details furnished by the employer in such columns and fields.

What are the components and structure of Form No. 16?

-

Form No. 16 is having two (2) parts i.e. Part A and Part B.

-

The Part A comprises of the details of the tax deposited by the employer to the Government Account.

-

If the employer is a Government or a Government undertaking, the payment is made by it via book entry and identified through Book Identification Number (BIN) and if the employer is other than Government and semi-Government bodies, the payments are done through Challans and identified via Challan identification Number (CIN).

The part A of the Form No. 16 is as follows:

-

The part A of Form No. 16 is to be automatically generated by the employer from TRACES portal of Income tax Department. This Part A has the unique number (Certificate Number) generated from this portal.

-

Look for this in Part A

-

Your PAN must be mentioned correctly

-

TAN of the deductor/employer must be mentioned correctly

-

Book Identification Number (BIN) must be correct

-

Challan Identification Number (CIN) must be correct

-

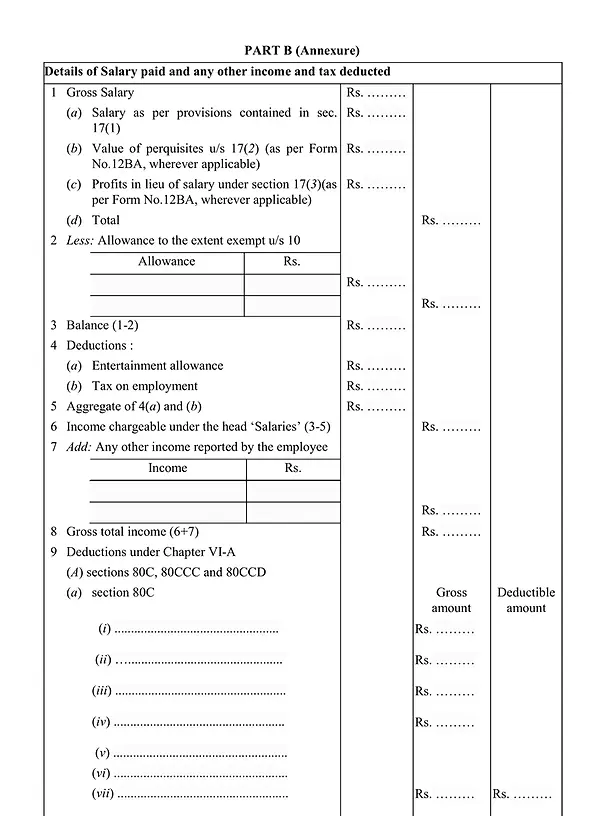

Part B of the Form 16 contains the details about the salary incomes and deductions claimed by the employee and his/her tax liability on such income. This is extremely important since it is used by employee to file his/her Income tax return.

It looks like this:

-

This form No. 16 Part B contains entire details in case you are filing ITR-1. Therefore, you need to understand it perfectly.

-

The income shown in Form 16 is an aggregate of your pay-slips

-

This must match with the 26AS statement of yours

-

This must contain all the deductions that you told your employer before he deducted your tax

-

In case of any discrepancy, you must contact your deductor and get the amended Form 16

This is the standard format of Form 16, however many organizations issue customised forms as per their requirements and specifications. However, the required basic details are same.

Frequently Asked Questions on Form 16

I have lost my Form No. 16. What to do?

-

Your employer may issue you a duplicate Form No. 16

I have worked with more than one employer in one year. Will I get two Forms 16?

-

Part A of the Form 16 contains details about TDS deposit by an employer and Part B contains details about incomes of the employee. You will be issued two Part A forms and in respect of Part B, you must have shared the details of incomes received by you earlier from earlier employment and such details will be incorporated by latest employer in Part B and only ONE part B will be issued to you.

I have not received Part A of the Form 16. What to do?

-

Part A of the Form 16 is generated by an employer from TRACES portal of the Income Tax Department and can only be generated if an employer has deposited the requisite amount of TDS with the Government Account. There is a possibility that he may not have deposited your TDS into Government Account. You need to follow up with your employer otherwise you may not get credit for prepaid taxes and your ITR may shown tax as payable.

Form 16A : Certificate of TDS for non-salaried receipts

-

In case of incomes other than salaries, the person who pays ou that income is required to deduct income tax (TDS) from such income. This deduction is done at a rate prescribed in Income tax Act.

-

After such deduction, the deductor deposits such amount of tax deducted into the Government Account.

-

After depositing this amount into the Government Account, the deductor is required to issue you the certificate of TDS. This certificate is issued in Form 16A.

-

This Form 16A is issued in case of incomes like interest, professional fees, commission and brokerage etc.

It looks like this:

-

The incomes reported in Form 16A are reflected in Form 26AS prepared by the Department, therefore, when your income is reported in form 26AS, you must report the same in your ITR filed for that assessment year.

-

Unlike in Form 16, this Form 16A does not have Part A and part B.

-

This Form 16A must be generated only on TRACES portal of Income tax Department.

Form No. 16B : Certificate of TDS in respect of immovable property transaction

-

This form is generated and issued in transactions of sale and purchase of immovable property like land, building or land and building, constructed space, shops, gala etc., but does not include agricultural land.

-

Once the payment is made by the purchaser to the seller, he must generate challan in form 26QB and generate Form 16B on TRACES and issue the same to the seller.

-

This form 16 is to be generated ONLY on TRACES and can only be generated if the payments of TDS are made by the purchaser.

-

It neither needs nor contains TAN but is issued on the basis of PAN of both the parties.

-

See Sample

-

Form No. 16C– TDS Certificate for TDS on rent

Form No. 16C is a certificate of TDS on payments of rent by an individual or HUF

-

If you are an individual or an HUF and you pay rent in amount of more than Rs.50,000/- to another person, then you are required to deduct tax on such rent payment at the rate of 5% of such an amount

-

Such TDS is not needed to be deducted at every time you pay rent, but in the last month of a financial year OR in the last month of tenancy if the tenancy doesn’t last till end of the financial year.

-

After deduction, this TDS is to be paid to the Government Account within 30 days from last of the month in which tax is deducted

-

After its deduction the TDS is to be paid and challan in form 26QC is generated from TRACES portal

-

The Challan in form 26QC is to be used for generating TDS certificate in Form 16C

Form 16C looks like this

Form 26AS or Tax Credit Statement

-

Form 26AS is an account statement of taxes paid by you, your TDS deducted, income tax refund received by you and your transactions in certain assets like mutual funds and shares etc., which are reported as specified transactions in AIR.

-

Whenever your TDS is deducted and paid to the Government Account, or you have paid advance tax or self-assessment tax, the same is recorded in Form 26AS and a report in that form is prepared after seven days of such payment.

-

This report can be accessed by you from Income Tax Department website incometaxindiaefiling.gov.in

-

The report in form 26AS is divided in SEVEN parts inter-alia A, B, C, D, E, F and G. Out of these parts A to F are relevant for every taxpayer and part G is relevant for taxpayers who is required to file TDS statements after deducting TDS.

-

The report in Form 26AS looks like this:

The parts of 26AS report are explained as below

Sr. No | Part of report | Contents |

|---|---|---|

1 | A | Details of TDS deducted by deductor. It should match with your Form 16 and the amount of TDS deposited is very important and it should match with your TDS deducted. |

A1 | In case of persons furnishing form 15G/15H, this row contains details of TDS deducted by deductor. The amount of TDS deposited is very important and it should match with your TDS deducted. | |

A2 | If you have sold your immovable property for more than Rs.50 lacs or given your property on rent, then your TDS at the rate of 1% of such amount should have been deducted. This row contains those details. | |

2 | B | In case you are governed by TCS provisions, this row indicates, amount of tax collected at source (TCS). TCS deposited must match with TCS collected. |

3 | C | This contains the details of advance tax or self-assessment tax paid, if any by you. The major heads in case of personal tax and corporate tax are 0021 and 0020 respectively. The minor head in case of advance tax is 100 and in case of self-assessment tax it is 300. You must verify these heads, BSR code and dates of deposit properly. |

4 | D | This row indicates the details about income tax refund paid by Income tax Department to you in the financial year. The amount of interest shown in this column must be offered as ‘income from other sources’ in the ITR for such financial year. |

5 | E | If you have done any high value transaction in the financial year, this will be reflected in this row. About 8 kinds of transactions shall be covered in this. These are: cash deposits of more than Rs.10 lacs, credit card payment of more than Rs.2 lacs, mutual fund purchase of more than Rs.2 lacs, bonds or debentures purchase of more than Rs.2 lacs, shares purchase of more than Rs.1 lac., immovable property purchase or sale of more than Rs.30 lacs, investment in RBI bonds of more than Rs. 5 lacs. |

6 | F | If you have bought immovable property for more than Rs.50 lacs or have been a tenant, then your TDS at the rate of 1% of such amount should have been deducted. This row contains those details. |

7 | G | This is relevant for the deductors, if you have deducted TDS and filed your TDS statements, then those statements will be processed by CPC-TDS. This row contains details of such TDS statements processing as to whether they are correct or not. |

How to view your 26AS statement?

This can be done in two ways:

-

Through your bank account through net banking facility (easier and recommended)

-

Log into your bank account

-

Look for tax related services

-

Click on the tab or button ‘view 26AS statement or tax credit statement’

-

It will be redirected to TRACES website of Income tax Department

-

TRACES website of Income tax Department is related to TDS and related functions

-

On TRACES website, click on ‘view 26AS’

-

Your 26AS form or Tax Credit Statement will be displayed.

-

Through Income tax e-filing website:

Step 1

Log in to Income tax website. After you log in you will see home page like this. Please spot on ‘My Account’ tab.

Step 2

Log in to Income tax website. After you log in you will see home page like this. Please spot on ‘My Account’ tab.

Step 3

Please choose ‘View Form 26AS (Tax Credit)’ button in the drop down menu.

Step 4

The following screen will be displayed. Press ‘confirm’ button on this screen. It will take you to a different website of TRACES i.e www.tdscpc.gov.in . The net banking route will also land on this web page.

Step 5

The following screen of TRACES portal will be displayed. Please click the check box and ‘proceed’ button.

Step 6

At this stage the form 26AS is generated. This screen will be displayed. Click on ‘view tax credit’.

Step 7

Select Assessment Year and the format in which you wish to see the tax credit statement in form 26AS i.e. HTML or PDF.

Step 8

Your Income tax credit statement or form 26AS form will be displayed as HTML as below.

Form 15G and Form 15H: No TDS application forms

-

When the tax on your total income is NIL or your income is less than the taxable income limit and you have income, which attracts TDS like rental income, interest income, EPF withdrawal, income from interest on corporate bonds or insurance commission or any such income, then you must avoid TDS on the same.

-

In case, your income is less than the taxable limit and you have not submitted form 15G or form 15H, then you need to file your ITR to claim the refund of TDS deducted. Thus, filing of form 15G/15H can save your money as well as effort of filing the income tax return.

-

The purpose of Form 15G and Form 15H is same but is meant for different class of taxpayers as per the eligibility conditions as below:

Form 15G | Form 15H |

|---|---|

Can be filed by individuals, HUF, and Trusts but not by Firm and company | Can be filed by individuals of age 60 or more years |

Can be filed by individuals of less than 60 years of age | Can be filed by individuals of age 60 or more years |

Can be filed by residents only | Can be filed by residents only |

The tax on the total income must be NIL | The tax on the total income must be NIL |

You must have PAN before you apply in Form 15G | You must have PAN before you apply in Form 15H |

The eligibility for application in form No. 15G/15H is illustrated for all classes of taxpayers below:

Taxpayer Person | Residential status | Maximum income eligible for Form 15G/15H | Age | Form Type |

|---|---|---|---|---|

Individual | Indian Resident | 2,50,000 | Below 60 years | 15G |

Senior Citizen (Individual) | Residential status | 3,00,000 | 60 years and above but below the age of 80 years. | 15H |

Super Senior Citizen (Individual) | Indian Resident | 5,00,000 | 80 years or above at any time during the year. | 15H |

Other than Individual (Association, HUF and Trust) | Indian Resident | 2,50,000 | Not Applicable | 15G |

How does it look?

Form 15G and Form 15H look alike. Sample is shown below

Please remember:

-

The Form 15G/Form 15H are filed mostly by the retired pensioners and people having pension and income from interest.

-

Non-Resident taxpayers can not avail this facility of from 15G/15H

-

The Form 15G/H are to be submitted by the taxpayer to the person paying the income like the Bank in which the taxpayer is having account, and which is paying him interest income.

-

These forms are not to be submitted to the Income tax Department. The person paying income is required to submit these forms in consolidated manner to the Income tax Department.

-

You must file multiple forms in case you are having different accounts in different banks or different branches of same bank. Each source of income will require single independent form.

-

The person who is paying income to you like Bank have to consolidate all such forms received by it and then give unique identification number to each of the form and submit the same electronically to the Income tax Department. Such details of the forms are also needed to be provided in TDS statements filed by such bank also.

FAQs on Form 15G/H

-

In Form 15G/H, what does ‘Estimated income’ in serial number 15 and ‘estimated total income’ in serial number 16 mean?

-

These forms are submitted in order to avoid TDS on a certain income like interest income. The amount of income on which this TDS is sought to be avoided is to be indicated in sr. no. 15 as ‘estimated income’.

-

In order to be eligible to avoid TDS on any income you need to have zero tax liability on your entire income from all sources. This is called as total income, and this must be indicated at sr. no. 16

-

-

If I file form 15G/H, does it mean that my income is not taxable, and I don’t have to file ITR.

-

These forms are filed in order to claim that your total income is below the taxable limit and to avoid TDS on specific income. This does not indicate that the income which you are receiving is NOT taxable.

-

-

What is the time limit during which these forms are to be submitted?

-

There is no fixed time limit but ideally, they should be filed in first or second week of April otherwise the deductor may deduct TDS on your income.

-

-

What are the incomes for which form 15G/H can be submitted?

-

These forms are submitted generally for following incomes

-

Income from interest on savings bank account and deposits

-

Income from rent

-

Income from insurance commission

-

Income from withdrawal from EPF

-

Income from interest on corporate bonds

-

-

How is this form to be submitted?

-

Many of the banks have made the facility of online submission of these forms. You need to visit the website of the bank and fill in certain details and the form shall be submitted.

-

In other cases, like rental income or PF withdrawal, you have to fill the form physically and then submit that to the TDS deductor.

-

-

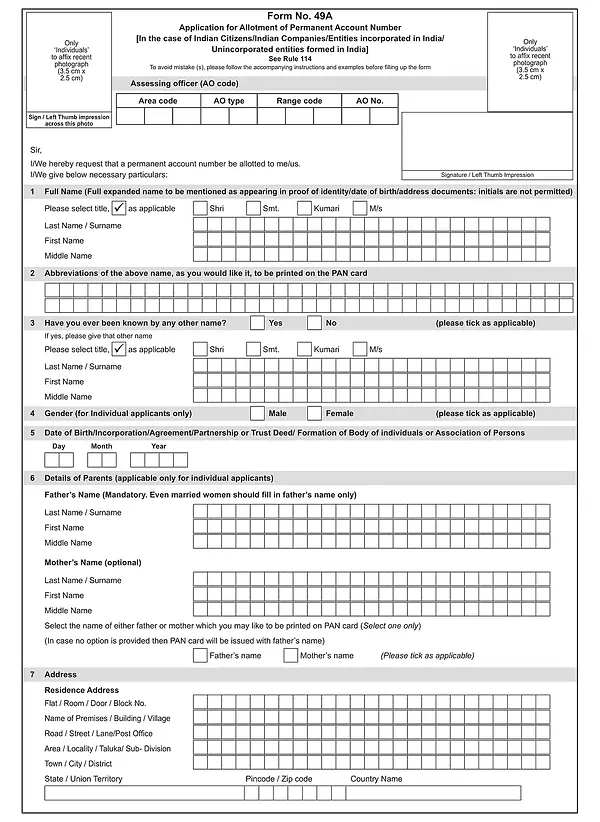

Form 49A: PAN card application form

-

A ‘Permanent Account Number’ (‘PAN’) is a ten-digit alphanumerical number which is issued by the Income-tax Department.

-

It is required by every person for the purpose of

-

quoting it in all correspondence, returns, statement, etc., sent by the person to the income-tax authorities, and

-

quoting it at the time of entering into certain specified financial transactions.

-

Every person whose total income during any previous year is more than the limit prescribed for taxable income is required to apply for a PAN.

-

Such an application is required to be made in Form No. 49.

-

Such application forms can be obtained from any IT-PAN service centres or downloaded from NSDL website or any website or any other vendor

-

The fee for processing PAN application is Rs. 107/- (including service tax). In case, the PAN card is to be dispatched outside India then additional dispatch charge of Rs. 887/- will have to be paid by applicant.

-

Those already allotted PAN shall not apply again as having or using more than one PAN is illegal.

-

However, request for a new PAN card with the same PAN or/and Changes or Correction in PAN data can be made by filling up ‘Request for New PAN Card or/and Changes or Correction in PAN Data’ form. The cost of application and processing fee is same as in the case of Form 49A.

-

The applicant will receive an acknowledgment containing a unique number on acceptance of this form. This acknowledgement number can be used for tracking the status of the application.

The Form No. 49 looks like this

The documents which need to be attached with this Form No. 49 are as below:

Sr. No. | Applicant | Documents as proof of identity, address and date of birth |

|---|---|---|

1 | Individual who is a citizen of India | 1.Proof of identity

2.Proof of address

3.Proof of date of birth

The regular documents that are required to be submitted as proof for other Government compliances would be enough here. |

2 | Hindu undivided family | (a) An affidavit by the karta of the Hindu Undivided Family stating the name, father’s name and address of all the coparceners on the date of application; and

(b) copy of any document applicable in the case of an individual, in respect of karta of the Hindu undivided family, as proof of identity, address and date of birth |

3 | Company registered in India | (a) Copy of Certificate of Registration issued by the Registrar of Companies; or

(b) corporate identity number allotted by the Registrar under section 7 of the Companies Act, 2013 (18 of 2013) |

4 | Firm (including Limited Liability Partnership) formed or registered in India | (a) Copy of Certificate of Registration issued by the Registrar of Firms/Limited Liability Partnerships; or

(b) copy of Partnership Deed |

5 | Association of persons (Trusts) formed or registered in India | (a) Copy of trust deed; or

(b) copy of Certificate of Registration Number issued by Charity Commissioner. |